|

| Image Source: accredify.co |

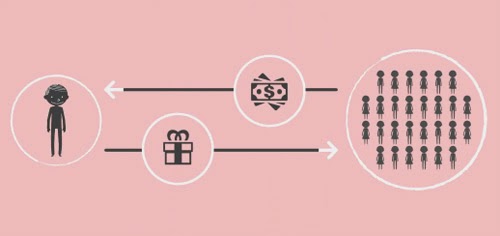

Crowdfunding is the practice of collecting small amounts of capital from individuals to finance a business or project through websites like Kickstarter and Indiegogo. In its infancy, crowdfunding was mainly used by non-profit organizations, artists, and individuals looking to finance a project or a cause and offering rewards, like a free t-shirt or a mention on a film's ending credits.

|

| Image Source: spreadbetmagazine.com |

In 2012, President Barack Obama signed the Jumpstart Our Business Startups (JOBS) Act into law to help revitalize the economy. In particular, the Title III of the JOBS Act allows unlisted small businesses to advertise and solicit funding from individual investors, making it easier for them to raise capital through equity crowdfunding. Through this, individuals can invest small amounts of capital in a startup in return for shares.

For many startups and small businesses, the idea sounds promising, but not good enough just yet.

As of now, the act limits the amount a non-accredited investor can invest: non-accredited investors with an annual income of below $100,000 can invest a maximum of five percent of their income or net worth, while those with an annual income of above $100,000 can invest a maximum of 10 percent. Startups are limited to raising a maximum of $1 million a year from non-accredited investors. Rep. Patrick McHenry, R-N.C., has proposed a bill to raise the amount of capital a startup can raise from $1 million to up to $5 million.

|

| Image Source: venturevillage.eu |

The JOBS Act is still a large step in the right direction. Equity-based crowdfunding may be new, but its impact is already being felt. It is opening the world of investing to a broader range of investors and providing small businesses with market exposure and easier access to capital.

Real estate equity-based crowdfunding is one of its biggest sectors. With this type of equity-based crowdfunding, investors can pool their efforts by purchasing shares in a house, apartment building, or any other type of real estate.

Tony Hartman of Denver is a financier and business coach with several years of experience in the real estate industry. For more discussions on property investment, visit this blog.